Recap of the Week 📊

Weekly News & Headlines 🗞

Value Investing (3 videos) — “The video focuses on finding undervalued companies with strong cash flows and potential for future growth, aligning with the principles of value investing.”

Highlighted stocks: CPRT, CROX, LULU, NOMD, SFM

Long-Term Investing (3 videos) — “Despite short-term market fluctuations, the presenter focuses on long-term investment opportunities with growth potential over the next 3–5 years.”

Highlighted stocks: ADBE, AMZN, CAKE, CPRT, CRM, CROX, HNST, LULU, NKE, PYPL, SFM

Cyclical Industry (2 videos) — “The airline industry is cyclical, which can impact AirCap's revenue and profitability.”

Highlighted stocks: AER, PJT

Most Talked-About Stocks 🗣️

These were the most frequently mentioned stocks across BuffQuant’s tracked channels this week:

NVIDIA (NVDA) — Sentiment: +0.25, Price: $192.57 (▲ 2.6%), Mentions: 6

PayPal (PYPL) — Sentiment: +0.73, Price: $75.75 (▲ 9.4%), Mentions: 3

AMD (AMD) — Sentiment: +0.70, Price: $232.89 (▲ 41.4%), Mentions: 3

SoFi (SOFI) — Sentiment: +0.40, Price: $28.45 (▲ 12.7%), Mentions: 3

Intel (INTC) — Sentiment: +0.35, Price: $37.80 (▲ 2.6%), Mentions: 2

Nike (NKE) — Sentiment: +0.28, Price: $68.06 (▼ 5.4%), Mentions: 2

Upstart (UPST) — Sentiment: –0.30, Price: $57.35 (0.0%), Mentions: 2

🟢 PYPL, AMD, and SOFI were this week’s standouts, combining strong bullish tone with notable price momentum, while NKE softened despite moderate sentiment.

📈 AMD’s +41% surge made it this week’s biggest gainer across tech-focused creators.

Rising Attention (WoW Change) 🔥

Stocks gaining more attention week-over-week among top creators:

AMD (AMD) — Sentiment +0.70, Price $232.89, ▲ 41.4%

SoFi (SOFI) — Sentiment +0.40, Price $28.45, ▲ 12.7%

PayPal (PYPL) — Sentiment +0.73, Price $75.75, ▲ 9.4%

NVIDIA (NVDA) — Sentiment +0.25, Price $192.57, ▲ 2.6%

Intel (INTC) — Sentiment +0.35, Price $37.80, ▲ 2.6%

Takeaways 🔍

AMD was the clear standout with a 40%+ surge, capturing momentum from both retail and creator communities.

SOFI and PYPL saw sentiment spikes amid renewed confidence in fintech.

NVDA and INTC kept consistent visibility, reinforcing strength in the semiconductor narrative.

Bullish Tone, Price Pullbacks 🐂

Some stocks drew positive YouTube sentiment but still declined over the past month — possible signs of overhype or hidden opportunity:

• Ferrari (RACE): Sentiment +0.60, stock –16.0%

• D.R. Horton (DHI): Sentiment +0.30, stock –10.7%

• Royal Caribbean (RCL): Sentiment +0.30, stock –5.1%

• Sprouts Farmers Market (SFM): Sentiment +0.60, stock –4.4%

• Crocs (CROX): Sentiment +0.40, stock –3.8%

💡 BuffQuant lets you check which channels historically get these calls right. Check channel performances

Stock Spotlight — PayPal (PYPL)🔦

This week’s featured stock is PayPal (PYPL), which appeared across several large channels and showed notable sentiment strength.

Mentions this week: 3 (Couch Investor, Financial Education)

Average sentiment (30 days): +0.59

Price at first mention (Oct 6): $71.29

Price latest (Oct 9): $75.75

Stock return since first mention: +6.3% vs S&P 500 –0.1%

Summary:

PayPal received higher-than-usual coverage this week with a consistent positive tone. The company’s stock outperformed the broader market during the same period, supported by favorable sentiment across creator discussions.

Who’s Covering PayPal?

Here’s how the channels discussing PayPal (PYPL) have performed on their past analyses:

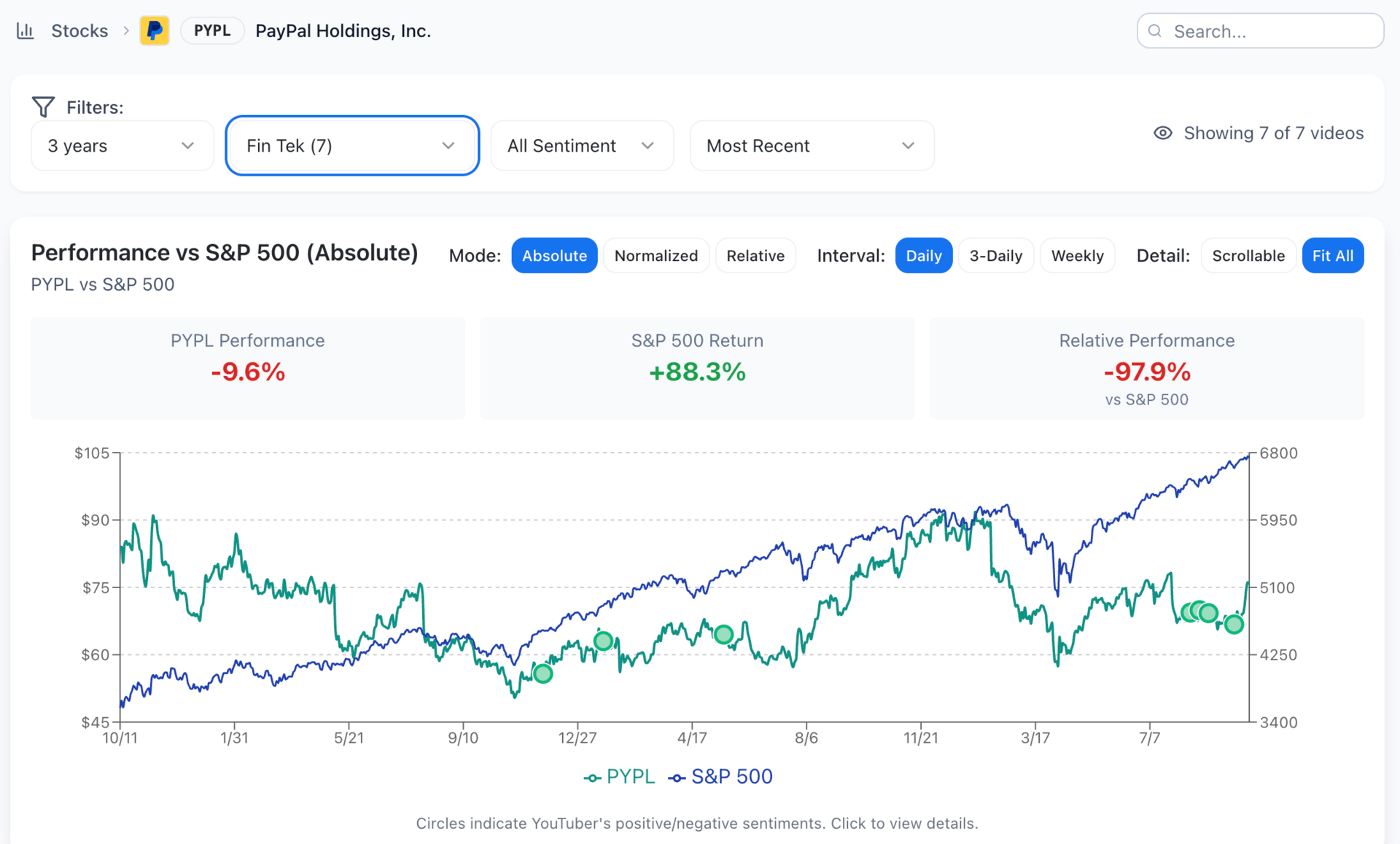

Fin Tek — 3 stock analyses in the last 2 years, +15% average alpha vs S&P 500.

Financial Education — 39 analyses, +7% average alpha vs S&P 500.

Value Investing with Sven Carlin, Ph.D. — 2 analyses, +4% average alpha vs S&P 500.

Couch Investor — 19 analyses, –3% average alpha vs S&P 500.

Everything Money — 7 analyses, –4% average alpha vs S&P 500.

BuffQuant tracks the historical accuracy of each creator’s stock calls, helping investors identify who tends to outperform the market over time.

Historical Performances of selected channel - FinTek: 📊

Thanks for Reading

That’s it for this week’s BuffQuant Weekly!

Did You Know?💡

We recently rolled out the Feed feature on BuffQuant — your personalized stream of the latest stock and channel takeaways. You can:

Follow your favorite channels and see their newest analysis.

Track stocks you care about and get the most recent sentiment shifts at a glance.

Quickly scan key takeaways without digging through every video.

👀 Fun fact: only a small % of our community is using Feed so far — but those who do tell us it’s become their go-to daily check-in. If you haven’t tried it yet, we wanted to highlight it for you this week!

ℹ️ Disclaimer

BuffQuant content is for educational purposes only and is not investment advice.

See you next week,

— The BuffQuant Team 🚀