📊Recap of the Week

🗣️Most Talked-About Stocks

All five names are AI or cloud beneficiaries. ORCL’s breakout story is the most dramatic, while AVGO and AMD are gaining buzz as challengers to the established giants (NVDA and GOOGL).

Top Mentions | Stock | Sentiment (TW) | Latest Price | Change% |

|---|---|---|---|---|

GOOGL | 0.50 | 240.80 | 2.47 | |

AVGO | Broadcom | 0.60 | 359.87 | 7.46 |

AMD | AMD | 0.50 | 158.57 | 4.92 |

NVDA | NVIDIA | 0.40 | 177.82 | 6.47 |

ORCL | Oracle | 0.40 | 292.18 | 25.51 |

Takeaways:

Alphabet (GOOGL): Strong ad revenue stability and AI initiatives (Gemini, Google Cloud AI) keep it top of mind as a safer mega-cap AI play.

Broadcom (AVGO): Gaining attention as an underappreciated AI supplier. The VMware acquisition and chip exposure fuel bullish sentiment.

AMD: Hot topic due to competition with NVIDIA in AI GPUs (MI300 chips). YouTube finance creators highlight its catch-up potential.

NVIDIA (NVDA): The face of AI. Despite sentiment moderating, strong earnings and market dominance keep it in the spotlight.

Oracle (ORCL): The surprise standout. A +25% stock surge tied to cloud partnerships and earnings beats has pulled significant retail attention.

*** Sentiment: -1=bearish , +1=bullish

🔥Rising Attention (WoW Change)

Big Tech is regaining focus. Even with minor pullbacks (AAPL, AMZN), sentiment remains positive as investors look toward AI product cycles and cloud growth. MSFT’s momentum shows leadership strength.

Riser Stock | Name | Sentiment (TW) | Price Latest | Return 7d % |

|---|---|---|---|---|

AAPL | Apple | 0.20 | 234.07 | -2.34 |

AMZN | Amazon | 0.35 | 228.15 | -1.80 |

MSFT | Microsoft | 0.30 | 509.90 | 3.01 |

🐂Bullish Tone, Price Pullbacks

These stocks saw a clear sentiment shift to bullish this week, even if prices haven’t yet followed.

Salesforce (CRM): Big sentiment jump from 0.34 → 0.70. Even with a small price dip, creators see upside in its fundamentals.

Upstart (UPST): First coverage in a while, likely tied to fintech/AI lending narratives. Despite negative returns, sentiment shift is notable.

PayPal (PYPL): Sentiment holding strong despite fewer mentions. Still seen as a turnaround/undervalued play.

Domino’s (DPZ): Retail attention picking up — “defensive growth” stock with new bullish tone.

Occidental (OXY): Energy name entering the conversation as oil themes resurface.

💡 BuffQuant lets you check which channels historically get these calls right. Check channel performances

🔦Stock Spotlight — Alphabet (ORCL)

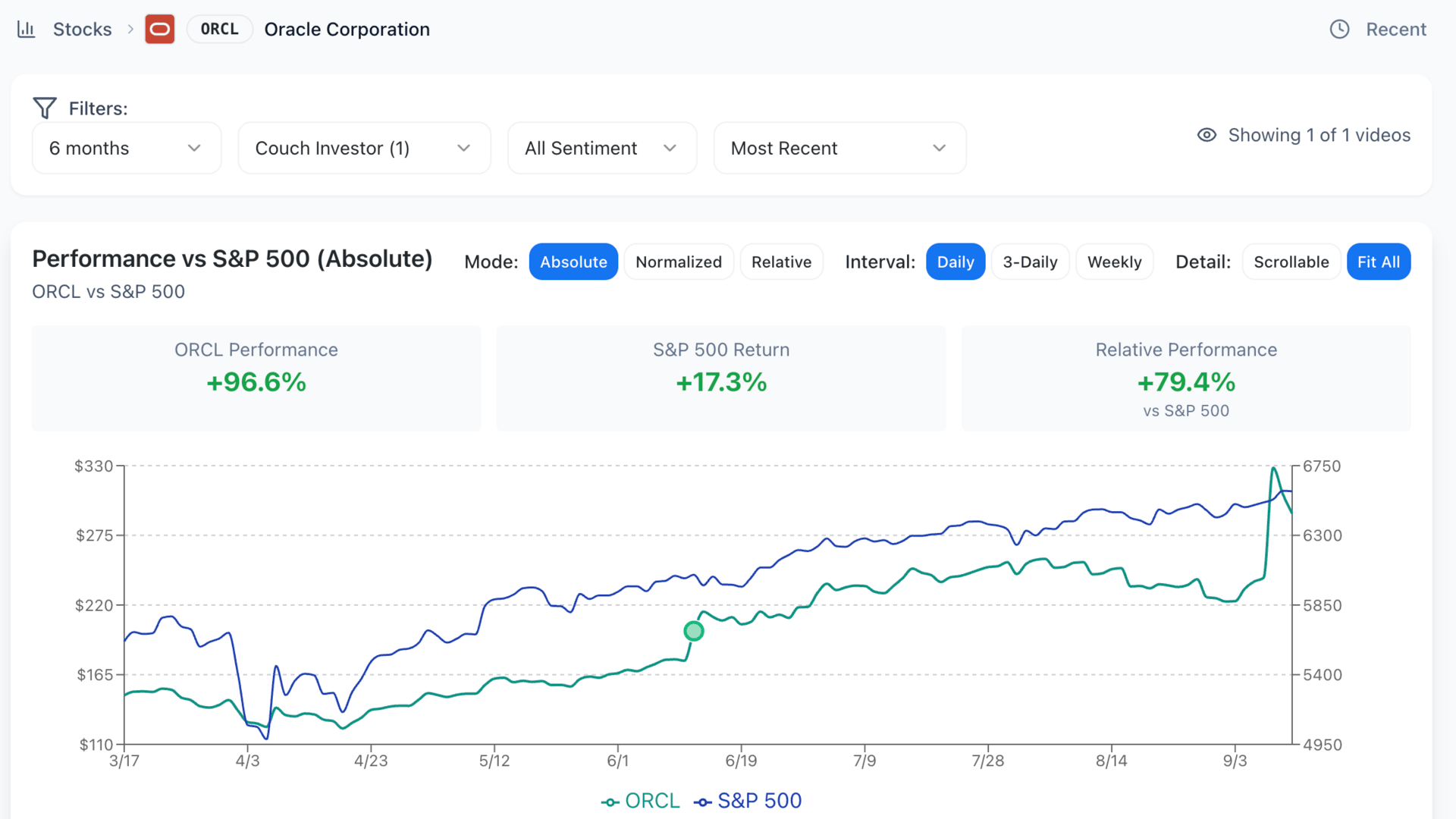

ORCL went from an AI-driven breakout to a quick reset as traders took profits after historic gains. Backlog and cloud growth pointed to multi-year AI demand for OCI; the scale of committed work surprised the market. Short-term buyers hit a valuation ceiling (premium multiple vs. MSFT/AMZN) and rotated after the spike.

📊Historical Performances of selected channel - Couch Investor:

Around mid-June, Couch Investor recommended a Buy for Oracle. Great analysis. Check channel’s page to see what “Couch” recommends to buy now.

🗞Weekly News & Headlines

Market Sentiment (2 videos) — “Better-than-feared news can lift beaten-down stocks.”

→ Highlighted stocks: GOOGL, OSCR, PYPL, SOFI, UBER, UNHValuation Concerns (2 videos) — “High valuations may cap returns compared to the S&P 500.”

→ Highlighted stocks: ADBE, FIG, WMValue Investing (2 videos) — “Stay disciplined: focus on quality businesses at reasonable prices.”

→ Highlighted stocks: BRK.B, LULU, NKE

🙏 Thanks for Reading

That’s it for this week’s BuffQuant Weekly!

💡 Did You Know?

We recently rolled out the Feed feature on BuffQuant — your personalized stream of the latest stock and channel takeaways. You can:

Follow your favorite channels and see their newest analysis.

Track stocks you care about and get the most recent sentiment shifts at a glance.

Quickly scan key takeaways without digging through every video.

👀 Fun fact: only a small % of our community is using Feed so far — but those who do tell us it’s become their go-to daily check-in. If you haven’t tried it yet, we wanted to highlight it for you this week!

ℹ️ About Sentiment

The sentiment score measures how positive or negative YouTubers are when talking about a stock.

very positive = +1 (bullish)

neutral = 0

very negative = -1 (bearish)

ℹ️ Disclaimer

BuffQuant content is for educational purposes only and is not investment advice.

See you next week,

— The BuffQuant Team 🚀