📊Recap of the Week

🗣️Most Talked-About Stocks

These were the most frequently mentioned stocks across BuffQuant’s tracked channels this week:

NVIDIA (NVDA) — Sentiment: +0.36, Price: $176.67 (▼ 0.6%), Mentions: 7

Intel (INTC) — Sentiment: +0.32, Price: $29.58 (▲ 19.4%), Mentions: 6

Alphabet (GOOGL) — Sentiment: +0.46, Price: $254.72 (▲ 1.2%), Mentions: 5

AMD (AMD) — Sentiment: –0.10, Price: $157.39 (▼ 2.3%), Mentions: 5

Meta Platforms (META) — Sentiment: +0.57, Price: $778.38 (▲ 1.8%), Mentions: 3

ASML (ASML) — Sentiment: +0.37, Price: $932.15 (▲ 7.5%), Mentions: 3

CrowdStrike (CRWD) — Sentiment: +0.23, Price: $502.55 (▲ 13.0%), Mentions: 3

Takeaways:

Tech stocks dominated conversations, with NVDA and INTC leading in mentions. Intel stood out with a +19% rally despite more modest sentiment, while CrowdStrike quietly gained double digits on relatively low but positive attention. Meta showed the most bullish sentiment score (+0.57), suggesting strong conviction even with fewer mentions.

🔥Rising Attention (WoW Change)

These stocks saw notable increases in coverage or discussion compared to last week:

NVIDIA (NVDA) — Sentiment: +0.36, Price: $176.67, 7-day return: ▼ 0.6%

Intel (INTC) — Sentiment: +0.32, Price: $29.58, 7-day return: ▲ 19.4%

AMD (AMD) — Sentiment: –0.10, Price: $157.39, 7-day return: ▼ 2.3%

Alphabet (GOOGL) — Sentiment: +0.46, Price: $254.72, 7-day return: ▲ 1.2%

Apple (AAPL) — Sentiment: 0.00, Price: $245.50, 7-day return: ▲ 3.7%

Chipmakers dominated the spotlight again. Intel is the clear outlier, delivering a 19% gain in just one week — the strongest move among risers. NVIDIA and AMD saw mixed fortunes, highlighting the volatility in semiconductors. Apple returned to the conversation with steady gains despite neutral sentiment.

🐂Bullish Tone, Price Pullbacks

Some stocks drew positive YouTube coverage but still dropped in the past month — a mix of hype, conviction, or potential buying opportunities:

Rocket Lab (RKLB) — Sentiment: +0.40, Stock ▼ 10.4%

Duolingo (DUOL) — Sentiment: +0.40, Stock ▼ 5.5%

Domino’s Pizza (DPZ) — Sentiment: +0.40, Stock ▼ 5.2%

Broadcom (AVGO) — Sentiment: +0.30, Stock ▼ 4.2%

Oscar Health (OSCR) — Sentiment: +0.30, Stock ▼ 1.9%

Investors voiced optimism, yet prices moved the other way. Rocket Lab and Duolingo stand out as the steepest drops despite bullish tones. These disconnects highlight where conviction meets market skepticism — and where past BuffQuant data shows channel accuracy can make all the difference.

💡 BuffQuant lets you check which channels historically get these calls right. Check channel performances

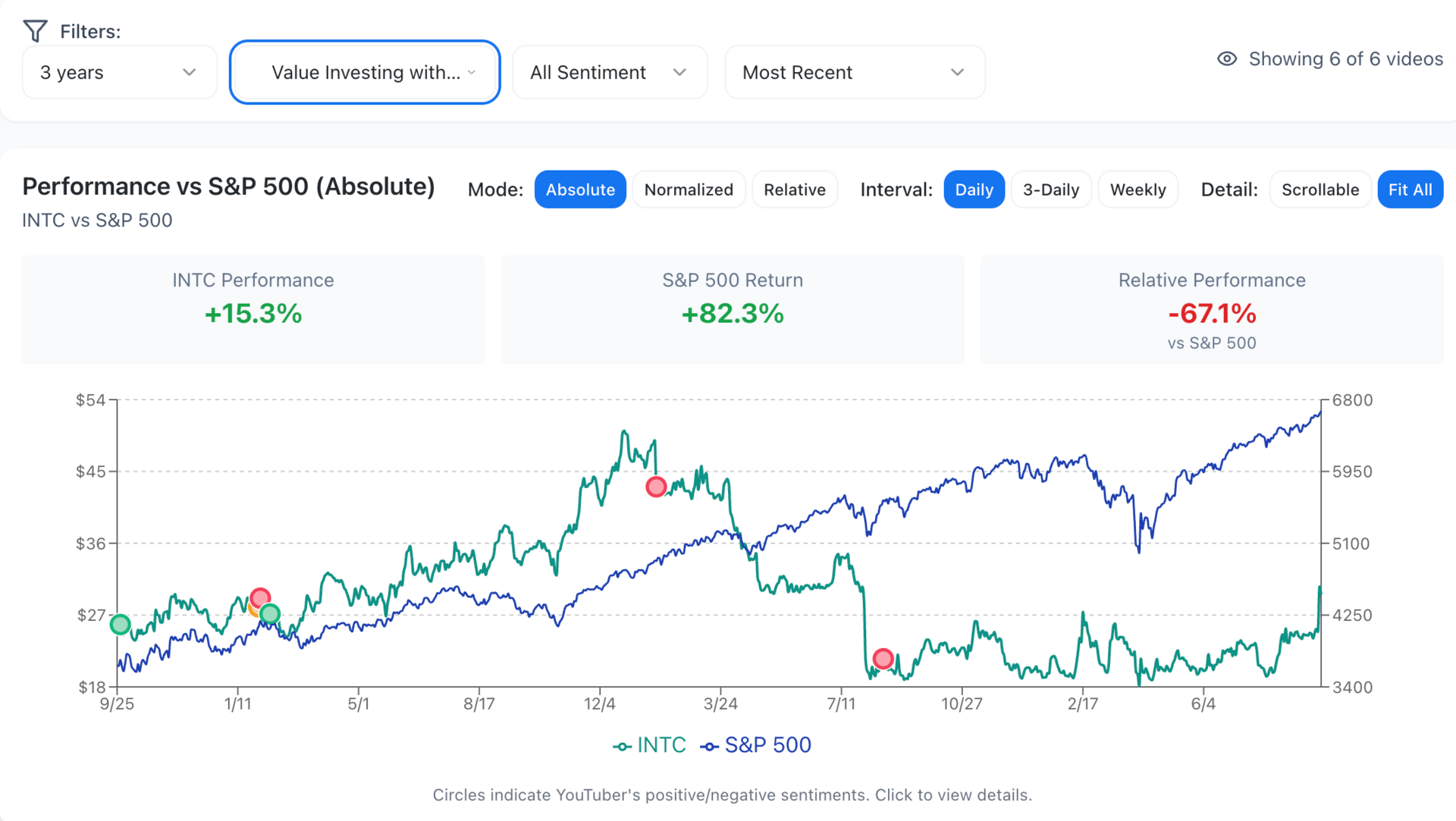

🔦Stock Spotlight — Intel (INTC)

This week’s most talked-about stock across BuffQuant’s tracked channels was Intel (INTC).

Mentions: 6 (covered by Couch Investor, Sven Carlin, Ticker Symbol: YOU, and others)

Average sentiment (30 days): +0.22 (cautiously bullish)

Price performance since Sept 16: ▲ 17.1% vs S&P 500 ▲ 0.9%

NVIDIA (7 mentions) and AMD (5 mentions) also drew heavy discussion, but Intel’s double-digit rally in just a few days made it the standout.

Who’s covering Intel?

Value Investing with Sven Carlin, Ph.D. — 2 picks, historically +0.37 alpha vs S&P

Learn to Invest – Investors Grow — 1 pick, historically –0.05 alpha

Couch Investor — 8 picks, historically –0.32 alpha

Fin Tek and Ticker Symbol: YOU also added views, though both have lagged the market historically.

Why it matters:

Intel’s surge sparked interest across a diverse set of channels. With some respected value investors (like Carlin) showing a history of outperformance, this week’s spotlight suggests Intel could be more than just a short-term momentum story.

📊Historical Performances of selected channel - Sven Carlin:

🗞Weekly News & Headlines

AI Revolution (2 videos) — “Jensen Huang stated that AI is powering a new industrial revolution and reinventing every layer of the computing stack.”

Highlighted stocks: AMD, ASML, INTC, NVDAAI as the New UI (1 video) — “AI is fundamentally changing the user interface to devices, with AI agents transforming how users interact with technology.”

Highlighted stocks: AAPL, INTC, NVDA, QCOMAI Agent Integration (1 video) — “Google and PayPal’s partnership underscores how AI-driven agents will integrate commerce and payments seamlessly.”

Highlighted stocks: AMD, ASML, CRWD, GOOGL, INTC, LRCX, META, NOVO, NVDA, PYPL, SNPS

Takeaway:

AI remained the dominant theme this week, from reshaping computing infrastructure to transforming how consumers interact with devices and commerce. Intel and NVIDIA were common threads across multiple narratives, reinforcing their central roles in the AI build-out.

🙏 Thanks for Reading

That’s it for this week’s BuffQuant Weekly!

💡 Did You Know?

We recently rolled out the Feed feature on BuffQuant — your personalized stream of the latest stock and channel takeaways. You can:

Follow your favorite channels and see their newest analysis.

Track stocks you care about and get the most recent sentiment shifts at a glance.

Quickly scan key takeaways without digging through every video.

👀 Fun fact: only a small % of our community is using Feed so far — but those who do tell us it’s become their go-to daily check-in. If you haven’t tried it yet, we wanted to highlight it for you this week!

ℹ️ About Sentiment

The sentiment score measures how positive or negative YouTubers are when talking about a stock.

very positive = +1 (bullish)

neutral = 0

very negative = -1 (bearish)

ℹ️ Disclaimer

BuffQuant content is for educational purposes only and is not investment advice.

See you next week,

— The BuffQuant Team 🚀